As a family, exploring new destinations doesn’t have to empty your wallet! Learn how to save big and even enjoy a free hotel stay every year with some clever travel hacks. This guide specifically focuses on the Hilton Honors Program, but the methods we’ll share can open doors to free stays with other loyalty programs as well. So grab your suitcase, and let’s discover how to make travel memories without spending a fortune!

Keep in mind that some links are paid affiliate links. When you buy through these links on our site, we may earn an affiliate commission. Any opinions expressed are not impacted by this.

Have you ever dreamed of winning a free hotel stay? Forget about the same old money-saving tips that ask you to give up your daily caffeine fix. I’ve got something extraordinary for you! Join me as I unravel how I regularly spend unforgettable days at hotels without parting with a single dime. That’s right – a 100% free stay, costing me only points earned from money I already spent.

But that’s not all. Did you know that with Hilton Honors points, you can score a free night’s stay after booking five nights using only points? This means you can stay for five nights and only pay for four! Intrigued? It’s a trick I’ve mastered as a loyal Hilton customer, and it works with several other loyalty programs too. The free hotel stay I chose in Montreal cost 35,000 points per night, but thanks to the 5th night free promotion, I indulged in a luxurious five-day stay for just 140,000 points. Ready to learn how you can embark on such an incredible journey too? Keep reading, and I’ll guide you every step of the way!

Hilton Honors Points: Your Gateway to Free Nights

What Are Hilton Honors Points and How Can You Benefit?

Hilton Honors points are like golden tickets to the world of luxury without splashing out your hard-earned cash. These are loyalty points earned when you stay at Hilton hotels or through various Hilton partnerships. Think of them as a reward for your loyalty to the brand, and who doesn’t love a reward?

Earn Points: Every time you stay at a Hilton property or spend using a Hilton branded credit card, you’re piling up these precious points.

Redeem Points: Once you’ve collected enough, you can redeem them for free nights, upgrades, or even experiences.

Now, let’s explore how to use these points strategically for the most bang for your (virtual) buck.

Your 5-Night Stay for the Cost of 4 Nights – The Hilton Magic!

Ever thought of enjoying a five-night stay and only paying for four nights with points? Well, with Hilton Honors, that’s not just a dream; it’s reality! Here’s how:

Choose Your Destination and Hotel: Pick a Hilton hotel that fits your style and budget. Different properties require different amounts of points.

Book Using Points: When booking, use your Hilton Honors points to pay for the stay. You’ll need enough points to cover four nights.

Enjoy the 5th Night Free: If you book a stay for five consecutive nights using points, Hilton rewards you with the 5th night free. So you only pay for four!

Example: A Fabulous Stay in New Orleans

Let’s illustrate this with my unforgettable five-day stay in steps from the French Quarter at the Roosevelt New Orleans – Waldorf Astoria.

Hotel Selection: I chose a free hotel room costing 40,000 points per night (during off-peak times).

Total Points for Four Nights: 40,000 points x 4 nights = 160,000 points.

The 5th Night Free: Thanks to Hilton, I enjoyed the fifth night without parting with any more points.

How to Get 160,000 Points for Your Dream Stay

Your next luxurious hotel stay might just be in your wallet. How, you ask? It’s through the magic of credit card sign-up bonuses, specifically tailored to earning points for free hotel stays. Let’s unravel this concept with some practical examples.

If you’re leaning towards Hilton for your next getaway, getting a Hilton Honors credit card could be your key to unlock those extra points.

The Options: Hilton Honors offers several credit cards, each bursting with unique bonuses and benefits.

Sign-up Bonuses: These cards come with appealing sign-up bonuses. For example, the Hilton Honors American Express Card grants 80,000 points if you spend $1,000 within the first three months.

By meeting this spending requirement, you could luxuriate in two free nights at a Hilton hotel requiring 40,000 points per night. Hold on; there’s more!

Timing is Everything: Special Promotions

Applying for the card during a special promotion might fill your points purse even more. Sometimes, Hilton Honors dangles enticing carrots like a 150,000-point sign-up bonus for their Hilton Honors Aspire Card with a $4,000 spending requirement within the first three months.

The Outcome: Imagine an entire week at a sumptuous Hilton property, all covered by points. Tempting, isn’t it?

Know the Fine Print: Read the Terms and Conditions!

Choosing the right credit card and timing isn’t enough; understanding the terms is vital.

Spend Wisely: Some offers require spending a specific amount within a set timeframe.

Read Carefully: Ensure you comprehend these prerequisites to escape any disappointment or confusion later on.

Making the Right Choice: Hilton Honors AmEx vs. Ascend vs. Aspire

The right credit card can make all the difference in reaching your travel dreams. Here’s how you can decide between Hilton Honors‘ various options.

Hilton Honors American Express Card (No Annual Fee)

Why It’s Recommended: The lack of an annual fee makes this an appealing option for many travelers.

Special Offers: Depending on the promotion, you might snag a $100 statement credit after your first purchase within three months. Additionally, a 100,000 Hilton Honors bonus points offer may be available after spending $1000 in purchases within the first three months.

Hilton Honors Ascend Card ($95 Annual Fee)

Break-Even Point: Consider your spending habits and how quickly you’ll accrue points. Will the benefits outweigh the $95 annual fee? That’s your break-even point.

Hilton Honors Aspire Card ($450 Annual Fee)

Luxury Option: This premium card has a hefty fee but offers exclusive perks. Assess your spending and credit levels to decide if this card aligns with your goals.

Hilton Credit Cards & Rewards Structure: A Comprehensive Guide

Here’s a chart to help you figure it out, remember these terms may change depending on when you apply, always pay close attention to the terms of the offers available and how they might work for your unique situation.

| American Express Hilton Honors | HH AmEx Ascend | HH AmEx Aspire | HH AmEx Business |

| No Annual Fee | $95 AF | $450 AF | $95 |

| Spend $1000 in first 3 months, get 80,000 bonus points. | Spend $2000 in first 3 months, get 130,000 bonus points. | Spend $4000 in first 3 months, get 150,000 bonus points. *Plus annual free weekend night reward | Spend $3000 in first 3 months, get 130,000 bonus points. |

| Hilton Hotel stays earns 7X per $1 | Hilton Hotel stays earns 12X per $1 | Hilton Hotel stays earns 14X per $1 | Hilton Hotel stays earns 12X per $1 |

| Purchases at U.S. restaurants, supermarkets, and gas stations earn 5X per $1 | Purchases at U.S. restaurants, supermarkets, and gas stations earn 6X per $1 | Purchases at U.S. restaurants earn 7X per $1 *also for flights booked through AmEx Travel, and car rentals booked direct | Purchases at U.S. restaurants and gas stations earn 6X per $1 *also for flights booked through AmEx Travel, and car rentals booked direct, wireless phone service, and business shipping |

| Complimentary HH Status – Silver *Upgraded to Gold when you spend $20,000 in a calendar year | Complimentary HH Status – Gold *Upgraded to Diamond when you spend $40,000 in a calendar year | Complimentary HH Status – Diamond | Complimentary HH Status – Gold *Upgraded to Diamond when you spend $40,000 in a calendar year |

(as found on American Express Hilton card comparisons) HH = Hilton Honors

Earning Points: Making Everyday Spending Rewarding

With Hilton Honors credit cards, everyday spending becomes an opportunity to earn points for your next luxurious stay. Here’s how you can maximize your earning potential without spending a dime more than you usually would:

- Paying Bills:

Utility and Cell Phone Bills: Consider paying these regular expenses with your credit card if there’s no added fee. You’re going to pay them anyway, so why not earn points in the process? - Grocery and Gas Spending:

No Annual Fee Card Example: If you choose a card without an annual fee and spend $335 per month on groceries and gas for the first three months, you’ll amass 75,000 points without extra cost.

Continuing the Habit: If you keep this up for the remaining nine months of the year, you could earn an additional 15,075 points. That’s calculated as 335 (dollars spent on groceries and gas) multiplied by 5 (points per dollar) for nine months.

A Smart Spending Strategy:

Pay Off Monthly: Always pay off the full amount each month. Since you’re spending this money on essential expenses like groceries and gas anyway, it won’t feel like a burden.

Make Your Money Work Harder: By aligning your spending habits with your travel goals, you turn everyday purchases into opportunities for travel. You’re not spending more; you’re just spending smarter.

With a thoughtfully chosen Hilton Honors card and a strategic approach to your daily spending, you can effortlessly accumulate points for a dream hotel stay. These aren’t extraordinary measures or sacrifices; it’s about using your existing budget wisely. Follow these steps, and you’ll be on your way to enjoying a luxurious vacation that doesn’t feel out of reach anymore. You’re already spending this money, so let it work in your favor!

Hilton Honors Points: More Than Just Hotel Stays

The Hilton Honors program transforms everyday actions into opportunities to earn points for memorable hotel stays. With over 15 hotel brands in its portfolio, including the luxurious Waldorf Astoria and iconic flagship Hilton brand, the program offers numerous ways to earn. Here’s how you can maximize your earning potential:

- Dining Rewards:

Hilton Honors Dining Program: Earn between 2x and 8x points per $1 spent at select restaurants. Your membership level determines your earning rate, turning dining out into a rewarding experience. - Refer Friends & Family:Generous Referral Bonuses: Refer friends and family to Hilton Honors, and both parties benefit. You’ll receive 20,000 points per referral, and your referred friend starts with an impressive 100,000 points.

American Express Card Referrals: Use a friend’s referral link when applying for an AmEx card, and if approved, you’ll both receive rewards. - Shopping Rewards:

Earn Points on Everyday Purchases: Get 5 points per $1 spent at restaurants, supermarkets, and gas stations, and 3 points per $1 on regular purchases. These quickly add up to future hotel stays.

Shop to Earn Mall Programs: Hilton Honors members can earn bonus points at over 1,000 retailers like Macy’s, Target, and Best Buy. Just log into your account, click through, and shop as usual. - Events and Meetings:

Earn for Planning Events: Hosting a wedding reception, conference, or meeting at a Hilton hotel? You can earn 1 point per $1 spent, adding a rewarding touch to your special occasion.

More Perks per Level

Bonus – Once you hit a certain level, you may be able to get your status matched at other hotels, car rental companies, or even cruise lines. I was able to get a status match at Best Western, Wyndham, and MSC. To see more possibilities for status matching, check out the Status Matcher.

The Proof is in the Stays (Not Just the Pudding!)

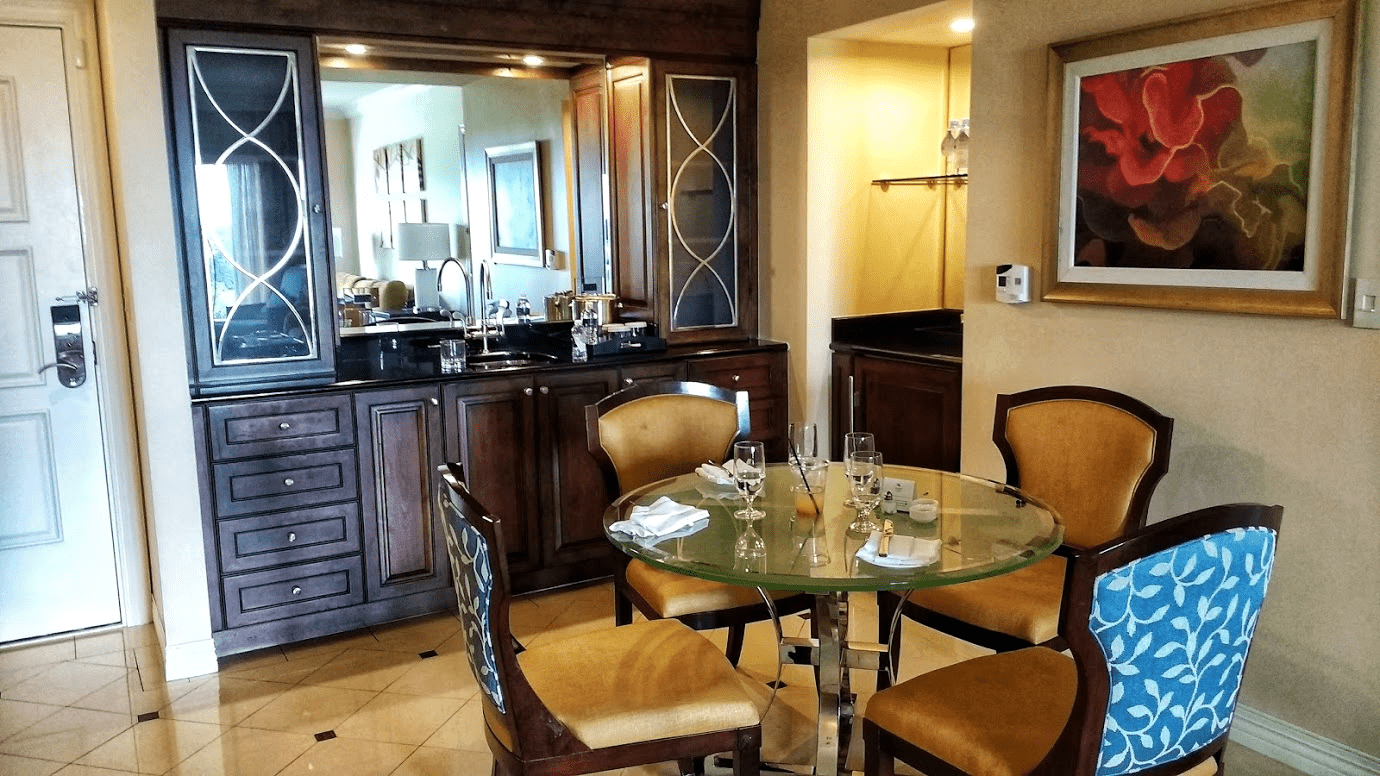

Over the last 7 years, we’ve been fortunate to experience the Hilton Honors program in action, earning free stays at a diverse array of hotels. From urban escapes to beachfront paradises, the rewards have turned ordinary trips into extraordinary memories. Here’s a glimpse of where we’ve been:

Upscale City Retreats:

Ritz Carlton New Orleans & The Roosevelt Waldorf Astoria New Orleans: A touch of elegance in the heart of jazz city.

Doubletree Montreal & Embassy Suites Chicago: Comfort and style in vibrant city centers.

Grand Bohemian Orlando & Doubletree Asheville: Boutique luxury and artistic flair.

Tropical Getaways:

Clearwater Beach & Sand Key Sheraton: Beach bliss and ocean views.

Baker’s Cay Resort Key Largo & Waterline Marina Bay Resort: Island luxury at its best.

Doubletree Key West: The perfect launching pad for a Key West adventure.

California Wine Country:

Embassy Suites Napa Valley & Townplace Suites San Mateo: Indulge in California’s wine culture and laid-back luxury.

Texas Comfort:

Courtyard Dallas & Doubletree Dallas: Big Texas hospitality meets modern comfort.

Florida Sunshine:Waldorf Orlando (twice) & Courtyard Tampa Downtown: Theme park thrills and urban chill in the Sunshine State.

And Many More:

Hilton Wolburn MA, Embassy Suites O’hare (Chicago), Embassy Suites Miami Airport, Versailles Waldorf Astoria, Embassy Suites Jacksonville Baymeadows.

These experiences serve as a testament to the Hilton Honors program’s potential, offering opportunities to explore, relax, and indulge at no extra cost. If you’re considering joining the program, we can personally vouch for its value. It’s not just the proof in the pudding; it’s the stays in the hotels that make all the difference!

Maximizing Loyalty Points: No Expiration, More Exploration!

Don’t Let Points Slip Through Your Fingers

Have you ever had loyalty program points that you let slip through your fingers, only to realize that they expired right before your next trip? It’s frustrating, isn’t it? We used to be in the same boat until we realized the untapped potential of our loyalty points.

Unlocking the Value of Loyalty Points

As seasoned travel enthusiasts, my partner and I have accrued points across various loyalty programs over the years. Initially, we assumed that we didn’t travel enough to make them worth our attention, letting them accumulate without much thought. It wasn’t until we started using our points for hotel stays, particularly with chains like Hilton and Marriott, that we discovered their hidden value.

Extend the Life of Your Points

Now, we understand that points can expire, and it might not always be feasible to use them all. That’s where transfer options come into play. Many loyalty programs offer the flexibility to transfer points to other programs. This strategy can not only extend the life of your points but also provide more diverse options for redemption.

Tip: Use them for free magazine subscriptions, donate them to charity, or track, exchange, and redeem them through apps like Award Wallet.

Timing and Flexibility

Remember, timing is key. Peak time matters when you’re booking, and you’ll use fewer points during off-peak seasons. Your points will stretch further, offering more value for your loyalty.

Tip: Utilize the availability calendar on Hilton’s site to find the best times to use your points. Cheap travel rewards flexibility, so stay adaptable.

Credit Challenges? No Problem!

Don’t be discouraged if credit challenges are holding you back. It’s never too late to start improving your credit and working your way to a free night.

- Check Your Credit: Understand what’s on your report and what needs improvement. Free resources include Credit Karma, Credit Sesame, and Annual Credit Report.

- Stick to a Budget: Treat your finances like a diet. Plan, stick to it, but allow occasional splurges to prevent disappointment.

- Seek Professional Help: While we’re here to talk about travel, many great resources can assist with credit improvement.

How to Raise Your Credit Score 100 Points

Your Next Free Vacation Awaits

The lesson? With careful planning, flexibility, and a healthy obsession with maximizing value, your loyalty points can turn into free vacations or weekend stays. It’s not just about accruing points; it’s about turning them into tangible travel experiences without breaking the bank. Start today, and who knows where your next free stay could be!